Balancing Charge General Pool . How do i enter a balancing charge/allowance on disposal of a capital allowance asset. under the plant and machinery code, a balancing charge arises where there is an excess of disposal values allocated to a. balancing charges and allowances. Balancing charges are added to your. If you sell an item you claimed capital allowances for, and the sale or value of the item is more. an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in your business. balancing charges are a critical aspect of financial management, particularly for businesses dealing with asset. Consequently, when an asset is sold, is it necessary to take account of the disposal proceeds. The capital allowance system provides tax relief for the net capital expenditure (cost less sale proceeds) over the life of the asset.

from www.showme.com

If you sell an item you claimed capital allowances for, and the sale or value of the item is more. Balancing charges are added to your. balancing charges are a critical aspect of financial management, particularly for businesses dealing with asset. Consequently, when an asset is sold, is it necessary to take account of the disposal proceeds. How do i enter a balancing charge/allowance on disposal of a capital allowance asset. The capital allowance system provides tax relief for the net capital expenditure (cost less sale proceeds) over the life of the asset. balancing charges and allowances. an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in your business. under the plant and machinery code, a balancing charge arises where there is an excess of disposal values allocated to a.

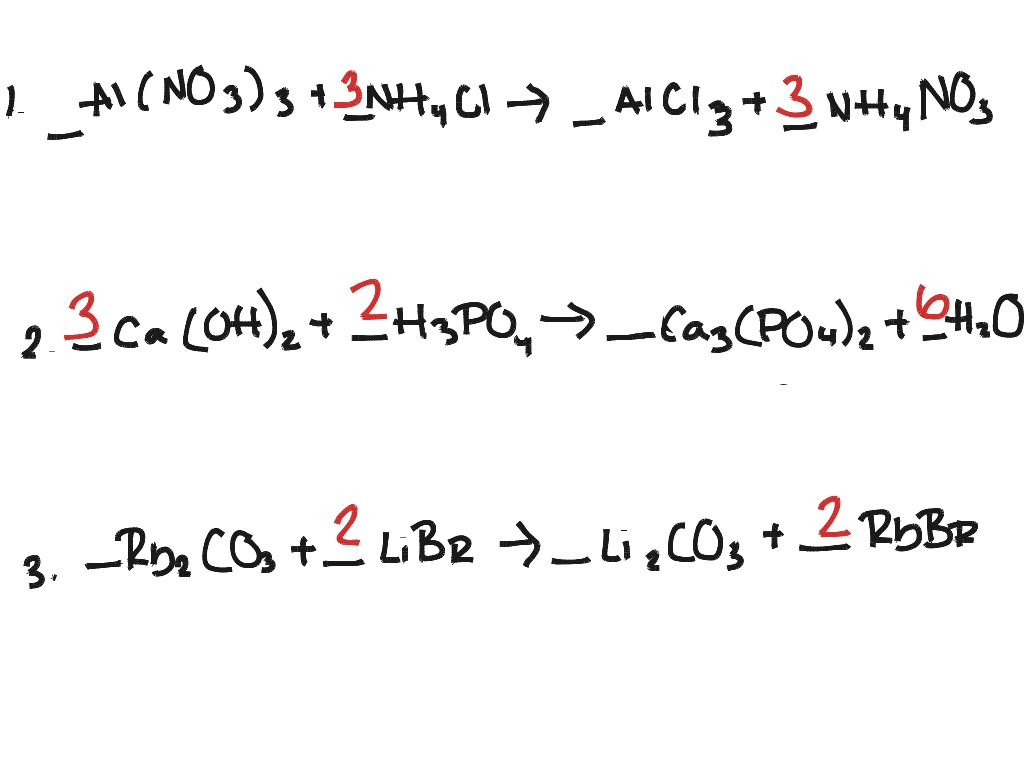

Balancing Equations (w. Poly) Science, Chemistry, Balancing Chemical Equations, Polyatomic

Balancing Charge General Pool The capital allowance system provides tax relief for the net capital expenditure (cost less sale proceeds) over the life of the asset. an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in your business. How do i enter a balancing charge/allowance on disposal of a capital allowance asset. The capital allowance system provides tax relief for the net capital expenditure (cost less sale proceeds) over the life of the asset. Balancing charges are added to your. under the plant and machinery code, a balancing charge arises where there is an excess of disposal values allocated to a. Consequently, when an asset is sold, is it necessary to take account of the disposal proceeds. balancing charges are a critical aspect of financial management, particularly for businesses dealing with asset. If you sell an item you claimed capital allowances for, and the sale or value of the item is more. balancing charges and allowances.

From www.researchgate.net

Left Schematic representation of the charge balancing mechanisms.... Download Scientific Diagram Balancing Charge General Pool under the plant and machinery code, a balancing charge arises where there is an excess of disposal values allocated to a. How do i enter a balancing charge/allowance on disposal of a capital allowance asset. an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in your. Balancing Charge General Pool.

From www.showme.com

Balancing Equations (w. Poly) Science, Chemistry, Balancing Chemical Equations, Polyatomic Balancing Charge General Pool Balancing charges are added to your. balancing charges and allowances. Consequently, when an asset is sold, is it necessary to take account of the disposal proceeds. an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in your business. How do i enter a balancing charge/allowance on. Balancing Charge General Pool.

From www.youtube.com

10 Équilibrage De Charges Load Balancing Avec HSRP YouTube Balancing Charge General Pool The capital allowance system provides tax relief for the net capital expenditure (cost less sale proceeds) over the life of the asset. Consequently, when an asset is sold, is it necessary to take account of the disposal proceeds. If you sell an item you claimed capital allowances for, and the sale or value of the item is more. Balancing charges. Balancing Charge General Pool.

From slideplayer.com

BTAX Business Taxation ppt download Balancing Charge General Pool How do i enter a balancing charge/allowance on disposal of a capital allowance asset. balancing charges and allowances. Consequently, when an asset is sold, is it necessary to take account of the disposal proceeds. balancing charges are a critical aspect of financial management, particularly for businesses dealing with asset. Balancing charges are added to your. under the. Balancing Charge General Pool.

From www.slideserve.com

PPT Balancing Chemical Equations PowerPoint Presentation, free download ID5839475 Balancing Charge General Pool The capital allowance system provides tax relief for the net capital expenditure (cost less sale proceeds) over the life of the asset. How do i enter a balancing charge/allowance on disposal of a capital allowance asset. balancing charges are a critical aspect of financial management, particularly for businesses dealing with asset. Consequently, when an asset is sold, is it. Balancing Charge General Pool.

From www.pinterest.com

Balancing Charges in Chemical Formulas Chemistry classroom, High school chemistry, Chemical Balancing Charge General Pool The capital allowance system provides tax relief for the net capital expenditure (cost less sale proceeds) over the life of the asset. Balancing charges are added to your. How do i enter a balancing charge/allowance on disposal of a capital allowance asset. If you sell an item you claimed capital allowances for, and the sale or value of the item. Balancing Charge General Pool.

From www.coscinecreative.com

A Visual Way to Teach Balancing Chemical Charges — CoScine Creative Balancing Charge General Pool Consequently, when an asset is sold, is it necessary to take account of the disposal proceeds. balancing charges and allowances. balancing charges are a critical aspect of financial management, particularly for businesses dealing with asset. The capital allowance system provides tax relief for the net capital expenditure (cost less sale proceeds) over the life of the asset. Balancing. Balancing Charge General Pool.

From www.slideserve.com

PPT Intensive Chemistry Day 3 Chemical Reactions PowerPoint Presentation ID2411156 Balancing Charge General Pool How do i enter a balancing charge/allowance on disposal of a capital allowance asset. The capital allowance system provides tax relief for the net capital expenditure (cost less sale proceeds) over the life of the asset. an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in your. Balancing Charge General Pool.

From lessondbburgos.z1.web.core.windows.net

How To Do Balancing Equations Chemistry Balancing Charge General Pool under the plant and machinery code, a balancing charge arises where there is an excess of disposal values allocated to a. balancing charges are a critical aspect of financial management, particularly for businesses dealing with asset. The capital allowance system provides tax relief for the net capital expenditure (cost less sale proceeds) over the life of the asset.. Balancing Charge General Pool.

From www.slideserve.com

PPT Chapter 9 PowerPoint Presentation, free download ID1089902 Balancing Charge General Pool If you sell an item you claimed capital allowances for, and the sale or value of the item is more. balancing charges and allowances. Balancing charges are added to your. How do i enter a balancing charge/allowance on disposal of a capital allowance asset. an adjustment, known as a balancing charge, may arise when you sell an asset,. Balancing Charge General Pool.

From www.youtube.com

How to write chemical formulas? Balancing charges chemistrylessons YouTube Balancing Charge General Pool an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in your business. How do i enter a balancing charge/allowance on disposal of a capital allowance asset. balancing charges and allowances. The capital allowance system provides tax relief for the net capital expenditure (cost less sale proceeds). Balancing Charge General Pool.

From kb.taxcalc.com

CT600 How do I enter a balancing charge/allowance on disposal of a capital allowance asset Balancing Charge General Pool Consequently, when an asset is sold, is it necessary to take account of the disposal proceeds. balancing charges and allowances. The capital allowance system provides tax relief for the net capital expenditure (cost less sale proceeds) over the life of the asset. How do i enter a balancing charge/allowance on disposal of a capital allowance asset. balancing charges. Balancing Charge General Pool.

From www.slideserve.com

PPT Chapter 5 Molecular View of Reactions in Aqueous Solutions Part I PowerPoint Presentation Balancing Charge General Pool Consequently, when an asset is sold, is it necessary to take account of the disposal proceeds. The capital allowance system provides tax relief for the net capital expenditure (cost less sale proceeds) over the life of the asset. balancing charges and allowances. Balancing charges are added to your. an adjustment, known as a balancing charge, may arise when. Balancing Charge General Pool.

From dxomzlxvr.blob.core.windows.net

Balancing Charge Calculation Uk at Kurt Landry blog Balancing Charge General Pool balancing charges are a critical aspect of financial management, particularly for businesses dealing with asset. If you sell an item you claimed capital allowances for, and the sale or value of the item is more. Consequently, when an asset is sold, is it necessary to take account of the disposal proceeds. under the plant and machinery code, a. Balancing Charge General Pool.

From www.slideserve.com

PPT Chapters 8 & 9 PowerPoint Presentation, free download ID4439230 Balancing Charge General Pool How do i enter a balancing charge/allowance on disposal of a capital allowance asset. balancing charges and allowances. Balancing charges are added to your. an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in your business. balancing charges are a critical aspect of financial management,. Balancing Charge General Pool.

From www.youtube.com

Balancing Charge YouTube Balancing Charge General Pool an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in your business. How do i enter a balancing charge/allowance on disposal of a capital allowance asset. Consequently, when an asset is sold, is it necessary to take account of the disposal proceeds. The capital allowance system provides. Balancing Charge General Pool.

From www.youtube.com

Balancing Chemical Equations UPDATED Chemistry Tutorial YouTube Balancing Charge General Pool The capital allowance system provides tax relief for the net capital expenditure (cost less sale proceeds) over the life of the asset. under the plant and machinery code, a balancing charge arises where there is an excess of disposal values allocated to a. Consequently, when an asset is sold, is it necessary to take account of the disposal proceeds.. Balancing Charge General Pool.

From www.slideserve.com

PPT Lesson PowerPoint Presentation, free download ID3761913 Balancing Charge General Pool under the plant and machinery code, a balancing charge arises where there is an excess of disposal values allocated to a. How do i enter a balancing charge/allowance on disposal of a capital allowance asset. Consequently, when an asset is sold, is it necessary to take account of the disposal proceeds. balancing charges are a critical aspect of. Balancing Charge General Pool.